Highlights From an Annual Property Conference in Las Vegas

National Developer Experiments With Giving Away Space

There are plenty of strategies retail landlords and property owners deploy in trying to attract tenants that will not only fill vacant space, but will help enhance the property as a whole. For Southern California-based Pacific Retail Capital Partners, it even means giving some space away for free.

At its retail properties across the United States, the real estate investment firm has found success with its Taste for the Space, a contest among local restaurateurs and operators in which prospective tenants compete to win a leasing package that includes up to a year of free rent, turnkey dining space, and an investment of as much as $50,000 to put toward its business.

Southern California Developer Pacific Retail Capital Partners tested out its Taste for the Space Contest at the Belden Village Mall in Canton, Ohio. (Pam Lawrentz/CoStar)

Beyond filling any empty space with a tenant closely linked to the surrounding neighborhood, Lemore Czeisler, Pacific's vice president of development, said Sunday during a panel discussion at ICSC's annual conference in Las Vegas, that the strategy has given smaller operators the boost they need to stay in a location for the long term, a challenge for any tenant in the food-and-beverage business.

Czeisler said Pacific has "a fantastic marketing team" that handles Taste for the Space.

"And they do this food competition," she said. "And local residents will have a competition with their cuisine, and whoever wins gets a year's worth of free rent in one of the restaurant retail spaces. And then that's an opportunity not only for buzz and engagement, but also for future leasing [for Pacific]. So that has been really successful. We have used that to tenant-up."

Pacific has hosted Taste for the Space competitions at properties in Ohio, Mississippi, Utah and California, identifying and securing regional food operators to help attract shoppers and boost daily foot traffic at its malls and retail centers.

The competitions have also helped generate a leasing pipeline of local culinary professionals, Czeisler said, and the property owner has even closed deals with nonwinning contestants to further strengthen its roster of food and beverage tenants.

A group of real estate leaders discuss the strength of the retail real estate market at the ICSC conference in Las Vegas. From left: Former VEREIT CEO Glenn Rufrano, Phillips Edison & Co. President Devin Murphy, Marcus & Millichap CEO Hessam Nadji, and First Washington Realty CEO Alex Nyhan. (Katie Burke/CoStar)

New ‘Real Estate Darling’

The national real estate market has been through several reckonings as the global economy has evolved throughout the pandemic to today's increasing economic uncertainty, but if one thing is clear, it's that the spotlight is now fully centered on retail space.

"Retail is the new apartments," Marcus & Millichap CEO Hessam Hessam Nadji told a group of attendees Monday at the three-day ICSC event. "Retail, clearly, is the new darling of the industry and is weathering everything much better than most property types. Apartments are now just trying to figure out what they're doing."

While rapid interest rate hikes, ongoing remote-work habits and skyrocketing inflation has pressured demand and pricing in other sectors — office being the primary example — a group of CEOs for some of the country's largest brokerages and investment firms all agree that, while there are plenty of challenges, there is still plenty of demand for retail properties.

When it comes to grocery-anchored sites, for example, Phillips Edison & Company President Devin Murphy said there is still plenty of activity in the market, "no question," and that the Cincinnati-based real estate investment trust still sees plenty of opportunity to acquire additional retail assets.

There is a pricing gap between sellers' expectations and what buyers are willing to pay, however, a chasm that has left some unrealistically priced properties sitting on the market, Nadji said. However, if property owners are willing to make the appropriate price corrections, it's a whole other ballgame.

"There is no shortage of capital, and we're seeing a reasonable amount of price corrections," Nadji said, which can be as much as 20% for multitenant properties and somewhere between 10% to 15% for single-tenant ones. "If those corrections are applied, you're getting multiple offers, even with the financing challenges and higher interest rates. There's an ability among buyers to deploy capital now with the plan to refinance later."

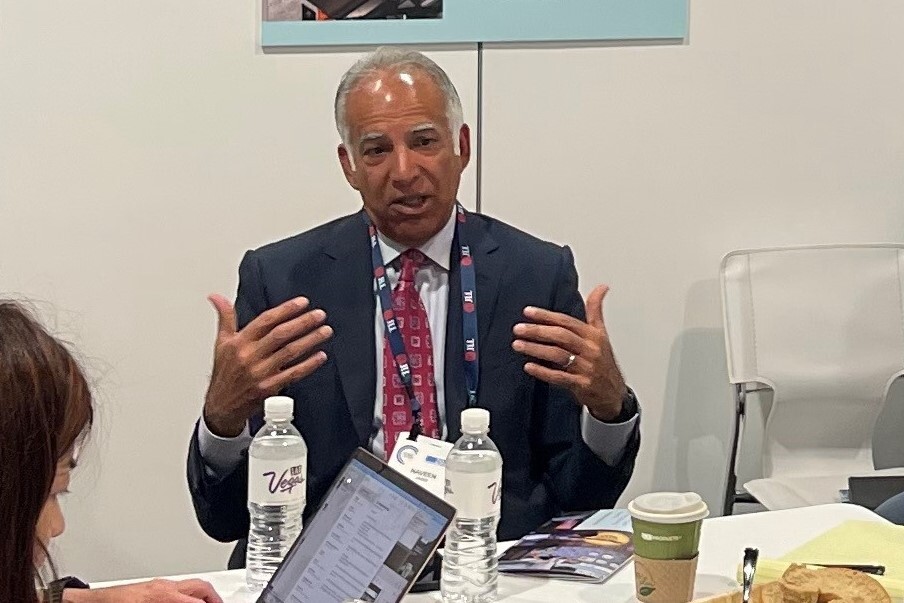

Naveen Jaggi, JLL's President of Retail Advisory Services, talks to reporters at a media breakfast that the brokerge held on Monday. (JLL)

Get ready for a new breed of pop-up shops selling merchandise tied to your favorite TV show, such as “Yellowstone,” the popular modern Western series on Paramount Network that stars Kevin Costner.

That's what Naveen Jaggi, JLL's president of Retail Advisory Services, told reporters at the brokerage’s annual press breakfast at ICSC on Monday.

“I can’t mention the brand’s name, but we’ve also heard stories lately about Hollywood and these major studios — Netflix, HBO — they come out with these great shows that have an amazing following, and they’re starting to create these pop-up locations or these experiential locations,” Jaggi said.

“Remember the ‘Friends’ pop-up a year ago, which was really popular?” he said. “Well now you’re hearing about a ‘Yellowstone’ pop-up and other examples of this coming, where they’re talking about how they can leverage the fact those studios have an immense amount of money, an immense amount of capital. So does Amazon. … When the [TV shows] take off, how do you leverage it? You do a small pop-up or experiential store, to put push that to the next level.”

It hasn’t actually happened yet, according to Jaggi, who added, “but we’re hearing about it," and he expects to see it.

Data Helps Find Sites in ‘Overstored’ Market

Retail site selection is more of a science than an art, according to several brick-and-mortar store operators.

Angele Robinson-Gaylord, senior vice president of store development for Rite Aid, and Christina Hernandez, senior real estate manager for the fast-growing Five Below chain, discussed their criteria for choosing a retail location during an ICSC workshop Sunday. The takeaway from them was to use detailed data. In today's environment, retailers are relying on analytics to not only open new locations but to optimize their existing fleet, which could mean consolidating some stores or relocating them, according to the panelists.

The site selection process isn't easy, Robinson-Gaylord said.

"We're trying to find those gaps between where we have current locations. ... We're in a time where we're overstored," she said to a packed audience. "That's probably blasphemy for me to say in a conference full of retail real estate professionals, but finding that needle in the haystack, to find an opportunity, to create net new growth is a challenge at this moment."

Bill Stinneford, executive vice president at the retail analytics firm Buxton, touted the need to be opportunistic when good retail locations are available.

"What you want to make sure that you have is data in that discussion, because if not, it's gut," he said. "And I always like to say the bad part about gut in the boardroom is typically there's a guy with the loudest voice, he or she wins that. And the loudest voice isn't always the right voice. So what does the data say so we can have a conversation based on fact and take the emotion out of it."